In the world of accounting, keeping accurate records of every transaction is crucial for the smooth operation of any business. One such tool used for recording small, day-to-day expenses is the Petty Cash Book. This is an essential part of financial record-keeping in businesses and educational syllabi, especially for Class 11 Commerce students. The Petty Cash Book Format Class 11 is a fundamental topic in the curriculum that helps students grasp the basics of financial transactions, expenditure management, and book-keeping.

This comprehensive guide will provide all the necessary details on the petty cash book format for Class 11, explain its purpose, discuss the entries, and present a step-by-step method for maintaining it. We’ll also look at the different formats used in various educational settings, especially the one that is relevant for Class 11 commerce students.

Table of Contents

- Introduction to Petty Cash Book

- Importance of Petty Cash Book

- Petty Cash Book Format

- 3.1. Single Column Petty Cash Book

- 3.2. Double Column Petty Cash Book

- 3.3. Triple Column Petty Cash Book

- How to Maintain Petty Cash Book

- Petty Cash Book Example

- Common Entries in Petty Cash Book

- Difference Between Petty Cash Book and Cash Book

- Advantages of Maintaining a Petty Cash Book

- Conclusion

- Disclaimer

1. Introduction to Petty Cash Book

The Petty Cash Book is a type of subsidiary book that records small amounts of money spent on minor or routine transactions. These are typically the kinds of expenditures that do not require a formal invoice or voucher, such as office supplies, travel expenses, or postage. The petty cash book serves as a detailed record of these small, often frequent transactions.

In businesses, the petty cash fund is managed by a petty cashier, who is responsible for overseeing these day-to-day cash transactions. Petty cash records are later summarized and posted into the main cash book and ultimately into the ledger.

2. Importance of Petty Cash Book

The Petty Cash Book is an essential tool for several reasons:

- Recording Small Expenses: It allows businesses to track minor expenses that are too small for a general ledger.

- Accountability: It helps businesses maintain transparency and accountability in managing cash resources.

- Cash Flow Monitoring: By keeping track of small transactions, businesses can manage their cash flow more effectively.

- Time and Cost Efficiency: It saves time by not requiring individual entries for every small purchase in the main ledger.

For Class 11 students, understanding the importance of a petty cash book is crucial as it introduces them to practical aspects of accounting and financial management.

3. Petty Cash Book Format

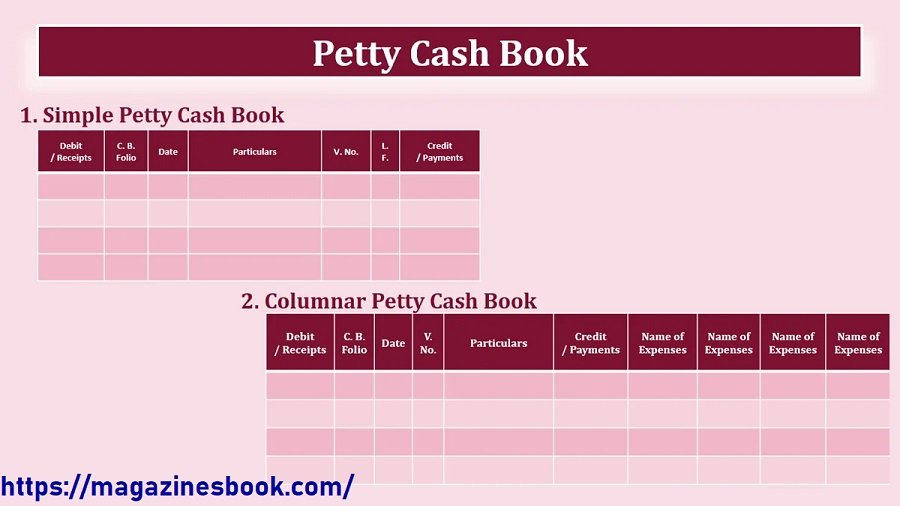

There are three basic formats for maintaining a Petty Cash Book: Single Column, Double Column, and Triple Column. The format used depends on the complexity and requirements of the business or educational syllabus. Let’s break down each format.

3.1. Single Column Petty Cash Book

This is the simplest form of a petty cash book. It has a single column for recording the amount spent. This format is suitable for businesses or educational purposes where transactions are straightforward and uncomplicated.

Format:

| Date | Particulars | Voucher No. | Amount |

|---|---|---|---|

| 01/01/2025 | Office Supplies | 101 | 50 |

| 02/01/2025 | Postage | 102 | 30 |

In this format, each expense is recorded with the date, the name of the item or service purchased (particulars), the voucher number for reference, and the amount spent.

3.2. Double Column Petty Cash Book

The Double Column Petty Cash Book has two columns: one for the amount spent and another for the amount received (if any). This format is more suitable for businesses where petty cash receipts (e.g., refunds, reimbursements) also need to be tracked along with expenditures.

Format:

| Date | Particulars | Voucher No. | Amount Paid | Amount Received |

|---|---|---|---|---|

| 01/01/2025 | Office Supplies | 101 | 50 | |

| 02/01/2025 | Postage | 102 | 30 | |

| 03/01/2025 | Reimbursement | 103 | 20 |

3.3. Triple Column Petty Cash Book

The Triple Column Petty Cash Book adds a third column for discounts or adjustments. This format is used in situations where businesses offer or receive discounts on petty cash purchases.

Format:

| Date | Particulars | Voucher No. | Amount Paid | Amount Received | Discount |

|---|---|---|---|---|---|

| 01/01/2025 | Office Supplies | 101 | 50 | 5 | |

| 02/01/2025 | Postage | 102 | 30 | 3 | |

| 03/01/2025 | Reimbursement | 103 | 20 |

4. How to Maintain Petty Cash Book

Maintaining a Petty Cash Book requires consistent and meticulous recording of every petty transaction. Here’s a step-by-step guide:

- Create a Petty Cash Fund: Start by setting up a petty cash fund. This is the amount of cash you will keep in hand for day-to-day transactions.

- Record Every Transaction: Every time money is spent from the petty cash fund, record the transaction in the petty cash book. Make sure to note the date, details of the expenditure, and the amount.

- Voucher System: Each expense should be supported by a voucher, which is a written record of the transaction (such as receipts, bills, or invoices).

- Balancing the Petty Cash Book: At regular intervals, balance the petty cash book to ensure the recorded expenses match the cash remaining in the fund. Any discrepancies should be investigated and rectified.

5. Petty Cash Book Example

Here is an example of a Single Column Petty Cash Book for better understanding:

| Date | Particulars | Voucher No. | Amount |

|---|---|---|---|

| 01/01/2025 | Office Supplies | 101 | 50 |

| 03/01/2025 | Stationery | 102 | 20 |

| 04/01/2025 | Travel Expenses | 103 | 100 |

| 05/01/2025 | Postage | 104 | 30 |

- Voucher No. 101: This could be the receipt for office supplies.

- Voucher No. 102: This could be the receipt for stationery.

By keeping track of these expenditures, businesses can ensure that petty cash is managed correctly.

6. Common Entries in Petty Cash Book

Here are some common types of entries you will encounter in a Petty Cash Book:

| Entry Type | Description |

|---|---|

| Office Supplies | Expenditures on items such as pens, paper, and other office materials. |

| Postage and Courier | Money spent on sending letters, parcels, or packages. |

| Travel Expenses | Includes transportation costs like taxi fares, bus tickets, etc. |

| Stationery | Expenses related to the purchase of items like pens, notebooks, and other writing materials. |

| Reimbursement | When a colleague or employee is reimbursed for small personal expenses. |

7. Difference Between Petty Cash Book and Cash Book

The Petty Cash Book and the Cash Book serve different purposes. Here’s a breakdown:

| Petty Cash Book | Cash Book |

|---|---|

| Used for recording small expenses | Used for recording all cash receipts and payments |

| Managed by a petty cashier | Managed by the main cashier |

| Only deals with petty cash transactions | Records both petty and major cash transactions |

8. Advantages of Maintaining a Petty Cash Book

Maintaining a Petty Cash Book comes with several advantages:

- Clear Record Keeping: Helps businesses track and manage minor daily expenses.

- Budget Control: It allows businesses to stick to their budget by tracking small purchases.

- Efficiency: Reduces the time and effort spent on managing small transactions in the main ledger.

9. Conclusion

The Petty Cash Book is a simple yet essential tool in managing the day-to-day expenses of a business. Whether you are a student of Class 11 Commerce or a business owner, understanding how to properly format and maintain a petty cash book is crucial for ensuring efficient and transparent financial management.

By following the formats provided and adhering to the steps for maintaining the petty cash book, businesses and individuals can better track their small expenses, ensure accountability, and ultimately maintain healthy financial records.

Disclaimer: The information provided in this article about the Petty Cash Book format for Class 11 is intended for educational purposes only. While every effort has been made to ensure the accuracy and completeness of the content, it is recommended to consult official textbooks, accounting guidelines, or professionals for the most up-to-date information. This article is not an official source of educational material and is not affiliated with any educational institutions.