Table of Contents

ToggleIntroduction

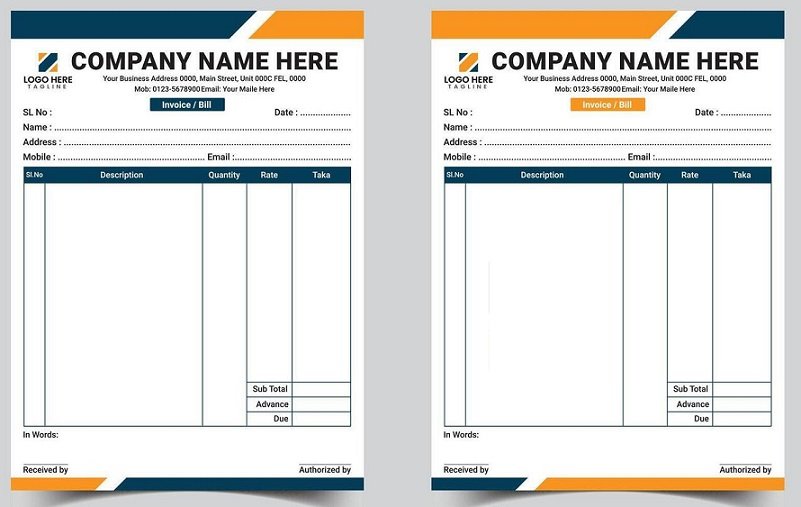

A Receipt Book Format is an essential tool for any business or individual involved in financial transactions. Whether you are a small business owner, freelancer, or a charity, having an organized and clear receipt format is crucial for maintaining transparency and professionalism. A receipt not only provides proof of transaction but also serves as a legal document in case of disputes.

In this comprehensive guide, we will cover everything you need to know about receipt book formats, including the different types of receipt books, essential components, legal considerations, and how to create a custom receipt book. You’ll also find practical tips and templates for efficient receipt management.

1. What is a Receipt Book?

A receipt book is a pre-printed or custom-made book used to issue receipts for payments received. It contains sequentially numbered receipts that help businesses track their financial transactions. These books can be used for a variety of transactions such as product sales, services, donations, and more.

Each receipt is printed on a perforated sheet, which can be torn out and handed over to the customer. The receipt serves as a proof of payment for goods or services provided.

2. Purpose of a Receipt Book

The purpose of a receipt book is to maintain a clear record of financial transactions between the business or individual issuing the receipt and the customer. Here are some key reasons why receipt books are important:

- Proof of Payment: Receipts serve as legal proof that a transaction has occurred and payment has been made.

- Record Keeping: Receipt books help in keeping track of sales, payments, and accounting records.

- Tax Compliance: For businesses, receipts are crucial for tax reporting and auditing purposes.

- Transparency and Professionalism: A well-designed receipt book adds a professional touch to your business operations.

3. Key Components of a Receipt Book Format

A well-designed receipt book includes several essential elements that help in recording and processing transactions accurately. Let’s break down the key components of a receipt book format:

| Component | Description |

|---|---|

| Receipt Number | A unique number that helps to identify each receipt in the book, ensuring no duplicates. |

| Date of Transaction | The date on which the payment is received or the transaction takes place. |

| Name of Issuer | The name or business name of the individual or company issuing the receipt. |

| Details of Goods/Services | A description of the items or services for which the payment has been made. |

| Amount Paid | The total amount of money paid, including taxes and other fees. |

| Mode of Payment | Whether the payment was made by cash, cheque, credit card, or other methods. |

| Customer’s Name | The name of the customer or payer who made the payment. |

| Signature of Issuer | A signature of the person issuing the receipt to verify authenticity. |

| Terms and Conditions | Any legal disclaimers or terms associated with the transaction. |

| Contact Information | The contact details (phone, email, or address) of the issuer for follow-up. |

4. Types of Receipt Books

There are several types of receipt books available, each catering to different business needs. Here are the most common ones:

4.1 Manual Receipt Books

Manual receipt books are physical books that contain pre-printed receipts. They are commonly used by small businesses or service providers who issue receipts by hand. These books typically have a carbon copy behind each receipt so that a duplicate can be kept.

4.2 Carbonless Receipt Books

Carbonless receipt books are a modern variation of manual receipt books. These receipt books use carbonless copy paper to create duplicate copies of the receipt. The original receipt is given to the customer, while the duplicate remains in the book for the issuer’s record.

4.3 Customized Receipt Books

Customized receipt books allow businesses to tailor their receipts according to specific needs, such as including the business logo, custom fields, and additional information. These receipt books are often used by businesses that want to project a more professional image.

4.4 Digital Receipt Books

With the advancement of technology, many businesses now use digital receipt books or receipt management software. These allow businesses to generate receipts electronically and store them in a secure cloud-based system. Digital receipts can be sent to customers via email or text message.

4.5 Online Receipt Templates

Some businesses prefer to create and print their own receipt books using online receipt templates. These templates can be easily customized, printed, and used as part of an electronic or manual receipt system.

5. How to Create a Receipt Book Format

Creating a receipt book format involves understanding the needs of your business and designing a format that includes all necessary components. Here’s how you can create your own receipt book format:

5.1 Choose a Layout

Decide on the layout of your receipt. The most common layout includes:

- A section for receipt number and date at the top.

- A larger section for details of goods/services.

- A space for payment details, including amount, mode of payment, and customer name.

5.2 Design Custom Fields

You can add custom fields such as order number, invoice number, or any other specific information that is important to your business. This could be helpful for keeping track of large transactions or special customer orders.

5.3 Branding

Incorporate your logo and business name to ensure that the receipt reflects your brand. This adds a professional touch and helps customers remember your business.

5.4 Ensure Legibility

Ensure that the font used in the receipt is clear and readable. Avoid using complicated fonts, as the receipt should be easy to read at a glance.

5.5 Legal Information

Include any legal disclaimers or tax information required by law, especially if you are running a business in a regulated industry.

6. Legal Considerations for Receipt Books

When using receipt books for business transactions, it’s important to ensure that they comply with local laws and tax regulations. Here are some key legal considerations to keep in mind:

- Receipts as Proof of Payment: Receipts are legal proof of a transaction and may be required in the event of disputes, audits, or legal claims.

- Tax Compliance: Ensure that receipts include appropriate details such as VAT or GST amounts if applicable.

- Record Keeping: Most businesses are required by law to keep copies of receipts for a certain number of years for tax and accounting purposes.

- Privacy: Be cautious about including sensitive customer information in your receipts. Ensure compliance with data protection laws.

7. Benefits of Using a Well-Formatted Receipt Book

A well-formatted receipt book provides several benefits, including:

| Benefit | Description |

|---|---|

| Efficient Record-Keeping | Keep accurate records of all transactions for tax and financial purposes. |

| Legal Protection | Receipts serve as proof in case of disputes or legal issues. |

| Professional Appearance | Well-designed receipt books convey professionalism and trustworthiness to customers. |

| Improved Customer Service | Customers appreciate clear and detailed receipts, making them more likely to return. |

| Tax Reporting | Easy tracking of taxable sales and expenses for tax reporting and compliance. |

8. Tips for Using a Receipt Book Effectively

To get the most out of your receipt book, here are some practical tips:

- Organize Your Receipts: Keep receipts in a sequential order to avoid confusion and ensure that all receipts are accounted for.

- Back Up Digital Receipts: If you are using a digital receipt book, always back up your data to avoid loss in case of system failure.

- Check for Errors: Double-check each receipt for accuracy before handing it to the customer.

- Use a Separate Receipt Book for Different Categories: If your business deals with multiple types of transactions, consider using separate receipt books for each category (e.g., sales, donations, services).

- Regularly Refill Your Receipt Book: Ensure that you always have enough receipts available, and reorder new books before the old one runs out.

9. Conclusion

A receipt book format is a crucial element in maintaining transparency, professionalism, and legal compliance in your business. Whether you’re managing a small business, freelancing, or handling personal transactions, understanding how to create and use receipt books can help you maintain organized records, comply with tax regulations, and provide excellent customer service.

By following the guidelines outlined in this article, you can create a receipt book that suits your specific needs, ensures accuracy, and adds value to your business operations.

Disclaimer:

This article provides general information regarding receipt book formats and is not intended as legal or professional advice. For personalized advice, especially regarding legal or tax matters, please consult with a qualified professional or legal advisor. Always ensure that your receipt books comply with local regulations and accounting standards.